MKS Instruments (MKSI) - Smid-Cap Semi Equipment

LT Thesis Accelerating with Multiple End Markets Contributing to Growth

Disclosure: We do own a long position in MKSI. Please read the remaining disclosures at the bottom of this post.

We have had a position since the inception of our thematic portfolio. We have covered MKSI since early last year, with an original intrinsic value estimate of ~$130 in January 2020. Please see the last page in the section titled “Analyst Coverage History” for our full coverage history of the name.

Exposed to many secular trends, the company is exposed to broader technology trends (5G, AI, big data, cloud) as well as advanced end markets such as electric vehicles (EV) and autonomous driving, med tech and industrial automation.

The company has undergone a lot of change in the last 5 years, financing two acquisitions in 2016 and 2019 that have diversified the company’s revenue exposure from primarily semiconductor end markets to now having a much more diversified business with their advanced end markets exposure.

The market has yet to re-rate the company to reflect this less cyclical, more diversified MKS.

Investment Summary

Company Description

MKS Instruments, Inc. (MKSI) is a semiconductor equipment company in the electrical components industry. The company provides an industry leading portfolio of instruments, systems, subsystems and process control solutions that measure, monitor, deliver, analyze, power and control critical parameters of advanced manufacturing processes, improving performance and productivity for their customers. The company serves the semiconductor, industrial technology, life and health sciences and research and defense industries. MKS was founded in 1961 in Massachusetts.

The company operates through three business segments – 1) Vacuum and Analysis, which provides a broad range of instruments, components and subsystems with focus on pressure management and control, flow measurement and control, gas and vapor delivery, gas composition analysis, electronic control technology, reactive gas generation and delivery, power generation and delivery and vacuum technology. 2) Light and Motion, which was created in conjunction with the acquisition of Newport Corporation in 2016, provides instruments specializing in lasers, photonics, optics, precision motion control and vibration control. 3) Equipment and Solutions, which was created with the acquisition of Electro Scientific Industries (ESI) in 2019 and provides laser-based manufacturing systems for the micro-machining industry that enables customers to optimize production of microelectronics. Equipment and Solutions’ primary served markets include flexible and rigid pricing circuit board (PCB) processing/fabrication, semiconductor wafer processing, and passive component manufacturing and testing.

In shorter words, MKSI provides machinery and laser-based solutions to advanced and semiconductor manufacturing industries, providing mission critical functionality used in the fabrication of integrated circuits (IC's, also known as semiconductors, the terms will be used synonymously throughout). In the below section, we'll break down the semiconductor manufacturing process step by step and where MKSI plays a role.

Semiconductor Manufacturing Process

Wafer Production

The process starts with wafer's, a thin, typically circular, disc that are made of raw elements (typically silicon, hence "Silicon Valley"). The Silicon is derived from sand and goes through multiple purification processes to reach the point where fabrication can begin to take place. These wafers are the base of integrated circuits (IC's) and require the highest purity to ensure proper functioning of the end product. In order to purify the solid silicon (raw material), it is placed in a molten liquid. As it cools, it forms a single crystal ingot (an almost diamond-shaped cluster). From there, the wafer is processed through a series of machines, where it is flattened, smoothed and chemically polished, creating a mirror-like surface. During this process, MKS's Vacuum & Analysis (V&A) tools are used to create the proper environment to ensure purity and temperature control.

Wafer Fabrication

Once the wafers are purified, they are ready to move to fabrication. This is when the IC's are formed in and on the wafer. These processes take place in extremely clean labs and can take anywhere from a week to months. Lithography is the process where the patterns of the circuit are built on the chip. The process involves the transfer of light-sensitive polymers (called photoresistors) that allow for complex structures to be etched into the wafer. This process is often repeated multiple times, creating layers on the chip to allow for increased product density (more power per size of the chip). The process uses photoresistors because they "resist" the following step, etching. Etching is the process where wet chemicals, such as acids or plasma is used to create holes and trenches for conductive paths, this is how energy (electricity) travels through the IC to perform the functions desired. Following the etching process, the photoresist layers are removed. Following the completion of the internal constructs of the IC, a step called Deposition is where the manufacturer connects the devices by adding layers of metals and insulators. This allows for energy to flow through the chip and insulates the chip from any outside particles which could damage product integrity. Typically, another layer of metal is applied for protection and incremental insulation. Again, MKS's tools contribute here in the gas and vapor delivery and control (Lithography), etching processes and deposition.

Wafer Inspection & Packaging

Following the completion of the internal composition and external protection, the chips are then inspected to ensure product purity, quality and functionality. MKS also offers tools for the inspection and packaging process. While this is the final step in the manufacturing process, it is of utmost importance for manufacturers to be able to certify throughput and product yield. The processes mentioned above are extremely complex and the smallest lapses can lead to the complete destruction of the entire chip.

Industry Overview

In a world that is becoming ever more reliant on data and cloud storage to continue driving technological advances, the case for the semiconductor equipment industry is strong. New end markets have come to the forefront in the last 5 or so years that continue to make this space attractive, including 5G, electric vehicles, autonomous driving, data centers, big data, artificial intelligence and other industrial applications. In the simplest terms, the more data created and more workforces and families that join the cloud, the more demand there will be for semiconductors. The more demand for semiconductors, the more demand for semiconductor equipment.

The industry has historically been thought of as a hyper-cyclical industry as the market has had difficulty gauging supply and demand, which have led to large inventory drawdowns that have dampened capital expenditure (CAPEX) spending. The low CAPEX environments bring on lower multiples due to the higher volatility in the fundamentals. We believe the market has underestimated the consolidation in the industry, which has brought on a more rational pricing environment, lessening the volatility of the sector and company margins. Further, with a number of new end markets mentioned above being more secular than cyclical, we believe this further contributes to the trend of less volatility in the sector. The market has yet to re-rate these stocks and we see a multiple re-rating as an incremental catalyst for the space.

The semiconductor equipment industry has undergone a lot of change in the last decade or so. Some drivers of the change include less cyclical end markets that we spoke about above and consolidation in the space to an oligopoly (and near duopoly between Lam Research (LRCX) & Applied Materials (AMAT)), improving capital returns due to the operational efficiencies, and increasing demand for more processing power and storage capacity. In the 1990’s-2000’s, the industry was driven primarily by PC (personal computer) spending which had a 2–3-year CAPEX cycle followed by a 1–2-year digestion period where CAPEX spending was down as end users worked through inventory. In 2010, mobile began replacing PC and investments became less cyclical as a new phone was being introduced every year or so. More recently, investments have been in DRAM and 3D NAND (memory chips) due to the surge in processing and data storage requirements. In the last decade, there were multiple suppliers that entered the industry, which created pricing volatility. Today, there are only a few major producers for DRAM (Samsung, Micron, SK Hynix) and four for NAND chips (Micron, Samsung, SK Hynix, Toshiba). Further, complexity in the industry is materially higher than the previous decade, requiring higher R&D intensity which drove a lot of players out of the market. Over time, these changes have led to a more rational pricing environment as weaker players have exited the industry. With this has come margin expansion and better cash returns for remaining market participants.

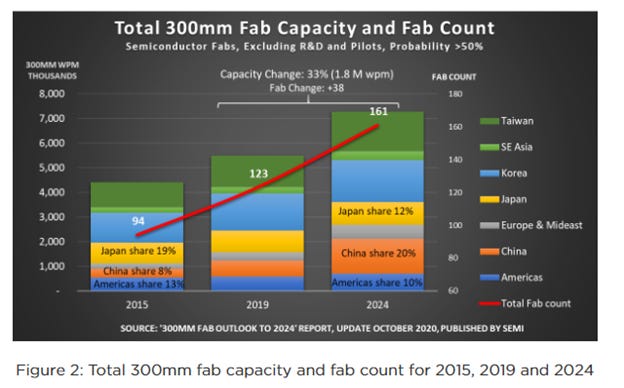

Semiconductor process equipment (SPE) spend has grown at an ~12% CAGR in 2015-2020E, representing a more than 4x premium to global GDP, highlighting the rapid growth of the space. Looking forward, we see the industry continuing to grow at a premium to global GDP (~5-9% CAGR) driven by rising demand for cloud services, laptops, gaming and healthcare technology. Fast-evolving technologies including 5G, the internet of things (IoT), electric vehicles/autonomous driving, artificial intelligence (AI) and machine learnings (ML) will continue to fuel demand for greater connectivity and larger data centers, providing a tailwind to semiconductor process equipment (SPE) spend. Through 2024, SEMI fab spending reports estimate 38 new 300mm Fabs (fabrication centers) will come online, with large spending coming from Taiwan, Korea and China.

MKS Addressable Markets

MKS has spent their time focusing on building long-term collaborative relationships with partners and customers across an array of end markets. The company has a diverse customer base, with primary markets being manufacturers of capital equipment for semiconductor manufacturing, industrial technologies, life and health sciences and research and defense. In their 2020 10-K filing, management noted three secular trends benefitting MKS:

Demand for increasing connectivity that has resulted in an explosion of data transmission, data storage, and data analytics, which has driven continued growth in advanced memory and logic chip demand.

Increasing complexity of technology transitions (miniaturization, laser-based processing) in semiconductor manufacturing. Management feels this offers them a competitive advantage as MKS is uniquely positioned to deliver a broad product suite of solutions across the manufacturing process.

Accelerating need for laser-based precision manufacturing, which are enabled by lasers, photonics, optics, motion and system solutions. As the complexity and minimization of technology increases, demand for laser-based solutions will continue to gain traction, which will be a tailwind for the L&M and E&S businesses.

MKS thinks about their business through the lens of two end markets, semiconductor markets and advanced markets.

Semiconductor Market – a significant portion of sales (~60% in 4Q20) are derived from the semiconductor end markets. MKS products are used in the major semiconductor processing steps, such as depositing thin films of material onto silicon wafer substrates, etching, lithography, metrology and inspection. Geographically, major semiconductor capital equipment manufacturers are concentrated in China, Japan, South Korea, Taiwan and the United States. This market represents MKS’s core competencies and legacy MKS business prior the acquisitions of Newport (Light and Motion) and ESI (Equipment and Solutions) businesses.

Advanced Market – a growth engine for MKS (~40% of revenue in 4Q20), the advanced market represents products used in industrial technology, life and health sciences and research and defense markets.

Within industrial technology, MKS applications include a wide range of products including flexible and rigid PCB processing/fabrication, glass coating, laser marking, measurement and scribing, natural gas and oil production, environmental monitoring and electronic thin films. Electronics thin films are a primary component of numerous products including flat panel displays, light emitting diodes (LED), solar cells and data storage. Industrial end market customers are located in developed and developing countries globally.

Life and health sciences applications include bioimaging, medical instrument sterilization, medical device manufacturing, analytical diagnostic and surgical instrumentation, consumable medical supply manufacturing and pharmaceutical production. Customers in this business are also located globally.

Research and defense products are sold to governments, universities, and industrial laboratories for applications including research and development in materials science, physical chemistry, photonics, optics and electrical materials. Defense products also include applications in surveillance, imaging, and infrastructure protection. Major laboratories are concentrated in China, Europe, Japan, South Korea, Taiwan and the United States.

Product Suite

MKS has an industry leading product suite, with a self-proclaimed industry leading position in 15 product categories. With over 2,200 patents worldwide, the company offers one the broadest product suites available. We will briefly run through the product suite by revenue segment below, further detail on these product categories can be found on form 10-K:

Vacuum and Analysis (legacy MKS) products include:

Pressure and Vacuum Control Solutions consisting of direct and indirect pressure management.

Materials Delivery Solutions including flow and valve technologies as well as integrated pressure management and control subsystems, which provide for precise control capabilities.

Power Delivery Solutions consisting of microwave, power delivery systems, radio frequency (RF) matching networks, and metrology products. These solutions are used to provide energy to various etching, stripping and deposition processes.

Plasma and Reactive Gas Solutions consist of reactive gas products, which create reactive species. A reactive gas is used to facilitate various chemical reactions in the processing of thin films, including the deposition of films, etching and cleaning of films and surface modifications.

Light and Motion (legacy Newport) products include:

Laser Solutions consisting of lasers including ultrafast lasers and amplifiers, fiber lasers, diode-pumped solid-state lasers, high-energy pulsed lasers and tunable lasers.

Photonics Solutions include optical components, lens assemblies and vibration isolation solutions. Photonics also includes instruments and motion products, such as high-precision motion stages and controls, hexapods, photonics instruments for measurement and analysis and production equipment for test and measurement customers.

Equipment and Solutions (legacy Electro Scientific Industries) products include:

Equipment and Solutions products consist of laser-based systems for PCB manufacturing, including flexible interconnect PCB processing systems and HDI solutions for rigid PCB manufacturing and substrate processing as well as passive component MLCC testing.

MKS Instruments Business Overview

Company Description

MKS Instruments, Inc. (MKSI) is a semiconductor equipment company in the electrical components industry. The company provides an industry leading portfolio of instruments, systems, subsystems and process control solutions that measure, monitor, deliver, analyze, power and control critical parameters of advanced manufacturing processes to improve process performance and productivity for their customers. The company serves the semiconductor, industrial technology, life and health sciences and research and defense industries. MKS was founded in 1961 in Massachusetts.

Management

MKS is led by President and CEO, John T.C. Lee who took over from now Chairman of the Board Gerard Colella in January 2020. Prior to Dr. Lee taking on the CEO role, he served as the company’s President and COO. Dr. Lee joined the firm in 2009 and has served as President and COO since May 2018. Prior to his role as COO, Dr. Lee served as Group VP from October 2007 to November 2016. Prior to MKS, he served in various capacities in other technology industries, including semiconductor and solar as well as plasma processing research at leading technology companies including Applied Materials (AMAT), Lucent Technologies, and AT&T Bell Labs. Dr. Lee holds a B.S. from Princeton University and both an M.S.C.E.P and Ph.D. from the Massachusetts Institute of Technology (MIT), all in Chemical Engineering.

Seth Bagshaw serves as the company’s CFO, Treasurer and Senior VP of MKS. He has been in his current role since May 2017 and as Treasurer since March 2011. Prior to his role as CFO, Mr. Bagshaw served as VP and Corporate Controller of the firm. Prior to joining MKS, Mr. Bagshaw served as VP and CFO of Vette Corp., an integrated global supplier of thermal management systems, from 2004-2006. He also served as Corporate Controller and VP of Varian Semiconductor Equipment Associates, Inc., a leading producer of ion implantation equipment used in semiconductor manufacturing. Other experience includes similar roles with Palo Alto Networks, Flextronics International and Waters Corporation as well as PricewaterhouseCoopers. Mr. Bagshaw is a CPA and has a B.S. in Business Administration from Boston University and an M.B.A. from Cornell University.

Growth Strategy

Since inception in 1961, MKS has been largely focused in the semiconductor industry. Through rapid innovation and investments in R&D, the business has undergone large changes since 2015. With the acquisitions of Newport Corporation (2016) and Electro Scientific Industries (ESI, 2019), the business has begun an expansion into advanced markets, leading to a less volatile and less semiconductor-dependent MKS. MKS growth in the future will be driven by secular trends we have touched on above as well as external growth through acquisitions. We will touch on both of these drivers in this section.

Secular Opportunities

As we have touched on earlier in this note, there are a number of secular trends driving organic growth for MKS. With their expansion and successful integration of Newport and ESI, the company is well-positioned to capitalize on a number of secular trends driving the semiconductor equipment industry. In their recent investor day presentation, management cited three key trends that will drive growth for the business organically moving forward:

Data growth fueling chip demand – In an ever-connected world, data and data storage is becoming more important. As workforces continue to move to the cloud and as emerging economies continue to adopt new technologies (mobile, PC, gaming etc.), demand at a global scale for MKS semiconductor tools will continue to be strong.

Mechanical to laser-based manufacturing – As the technology within semiconductors and semiconductor equipment continues to be more complex, precision and product yield become mission critical. Microelectronics are becoming an industry norm. This smaller technology requires more precise tools and processes to manufacture in order to reach the same product density as mechanical manufacturing. MKS’s laser solutions are addressing these trends.

5G and IoT proliferation – Expanding on the first point, in a world that is more ever connected, the internet of things is entering our homes, automobiles and workplaces. With this ubiquitous expansion of electronics comes an opportunity for the business to capture incremental market share gains through strong R&D investment and operational execution with new design wins.

Acquisitions

MKS management has been active in the M&A space since their inception and has reiterated their willingness to continue growing through acquisitions. Two of the largest transactions to date were the acquisitions of Newport (Light and Motion business) in 2016 and ESI (Equipment and Solutions business) in 2019. These acquisitions have brought in new capabilities to address new end markets, further diminishing MKS’s reliance on the semiconductor industry. Further, we see the successful integration of Newport and ongoing integration of ESI as a testament to managements growth strategy and operational capabilities. In the span of 5 years, management has transformed the makeup of the company with minimal operational lapses. The MKS that emerged is stronger, more diversified and less reliant on semiconductors (read: less cyclical).

Customers

The company sells products to thousands of customers worldwide across a wide array of end markets. In the last three fiscal years, MKS’s top ten customers accounted for 33%, 41% and 43% of total revenues. No individual customers accounted for more than 10% of revenues in 2019. In 2017-2018, Applied Materials (AMAT) accounted for 12% and 13% of revenues and Lam Research (LRCX) contributed 11% and 12% of revenue, respectively. We believe this customer diversification will continue as MKS gains momentum in new advanced markets and continues to widen out their addressable market. We still see the company as a derivative play on AMAT and LRCX given high correlations amongst the respective firm’s semiconductor-derived revenues.

Competition

The market for MKS products remains a cyclically-leaning business with high barriers to entry but high competition. Competitive factors include product quality, historical customer relationships, product line breadth, ease of use, manufacturing capabilities and responsiveness and customer service and support. Management notes that they face substantial competition in most product lines, but no single competitor competes across MKS’s product suite. We believe the diverse product platform gives MKS a competitive advantage as they have more cross-selling opportunities and more broad-based conversations with customers to get better information into technological inflection points, which has benefitted their surround the work-piece strategy. Named competitors include:

Advanced Energy Industries Inc. – power delivery and reactive gas generators

Hitachi Ltd., Horiba Ltd. – mass flow controllers

Inficon, Inc. – vacuum gauging and measurement and gas analysis

Brooks Instrument, VAT, Inc. – vacuum components

Sigma Koki Co., Ltd. – optics and photonics

Coherent, Inc. – lasers and photonics instruments

Qioptiq – lasers and optics

IPG Photonics, Inc. – laser

Jenoptik AG – laser, optics, photonics

PI miCos GmbH – photonics

Thorlabs, Inc. – optics, lasers and photonics

Trumpf Group, Lumentum Holdings, Edgwave GmbH and Amplitude Systems SA – laser

Via Mechanics, Ltd., EO Technics Co., Ltd, LPKF Laser & Electronics AG, Mitsubishi Electric Corporation, Han’s Laser Technology Industry Group Co., Ltd. – laser systems

Humo Laboratory Ltd. – component testing

MKS’s product suite is protected by a combination of patent, copyright, trademark and trade secret laws and license agreements that establish and protect proprietary rights expiring as various dates through 2039. The company currently holds 724 U.S. patents and 1,501 foreign patents as of December 2019 with another 107 U.S. patents pending. MKS ensures employees, including executive officers sign standard agreements in which employees agree to keep confidential all proprietary information and to assign to us all inventions while they are employed at MKS.

Business Model

Revenues

The company generates ~60% of revenues from semiconductor end markets, down from ~70% in 2016 prior to the Newport acquisition. The remaining ~40% of revenues come from advanced markets, which we have discussed at length earlier. We expect this revenue profile to continue at ~60/40% for the foreseeable future.

A large portion of company revenue still comes from the legacy MKS vacuum and analysis (V&A) business, with legacy MKS contributing ~61% of total revenues. Newport’s light and motion (L&M) business contributes ~30% with the remaining ~9% coming from ESI’s equipment and solutions (E&S) business.

Gross Margins

Costs of revenue primarily include the cost of machinery associated with the sales of product. Manufacturing facilities are located across the globe including Austria, China, France, Germany, Italy, Israel, Mexico, Romania, Singapore, South Korea and the United States. At the end of 2019, the company had approximately 3,400 employees in the manufacturing services divisions.

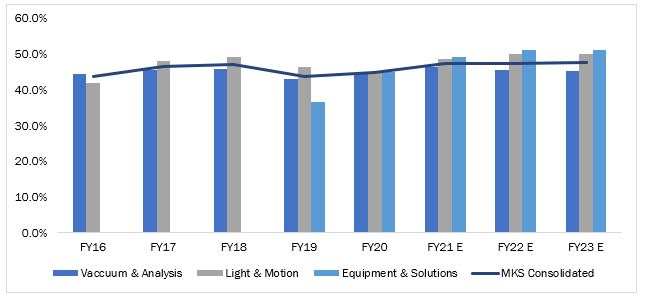

MKS sports an industry average gross margin profile of ~45%. In their long-term target model, management has guided to a long-term non-GAAP gross margin of ~50%, which was nearly achieved prior to the acquisition of ESI in 2019. As the business has become more integrated with time, gross margins in the segment have risen from ~20% to in line with the other segments at ~40-45%. We believe the gross margin expansion can be achieved through continued consolidation in the semiconductor equipment industries as we discussed prior. Further, management has shown solid operational execution with previous acquisitions which gives us confidence in their ability to continue to seek cost synergies which will be a tailwind for gross margins.

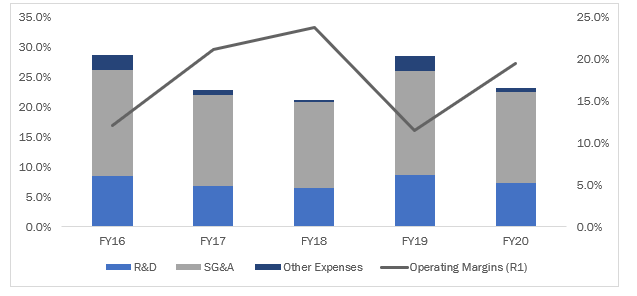

Operating Expenses

Given the relationship-focused nature of semiconductor equipment sales, the company spends a majority of its operating costs on sales, marketing, service and support efforts. The company focuses on building long-lasting relationships with customers through their iterative sales process, helping to cultivate a positive experience with customers and build rapport. We believe these efforts have been beneficial as the company has had success cross-selling their broad product suite. As of December 2019, the firm had approximately 560 sales employees worldwide. Given the machinery-centric nature of semiconductor devices, the firm has local repair, field service and customer support personnel located in key end markets. Product warranty periods typically range from 90 days to one year, depending on the type of repair needed.

As a result of the increased complexity in semiconductor equipment and processes, the firm has a significant research and development team of ~760 employees globally. Key initiatives in the R&D space have been the shrinking of integrated circuit dimensions, technological inflections, flat panel display and solar markets. MKS works with academic institutions and other labs that are at the leading edge of technological advances to continue to fuel their efforts to expand their capabilities and product offerings. MKS also leverages their broad customer base to have collaborative discussions with customers, seeking to understand their needs and get insights into potential inflection points and invest heavily in them. R&D projects typically have life cycles of 3-30 months, depending upon whether the product is an existing enhancement or a new product.

Management has guided to a long-term target operating margin of ~40%, which will come from synergies unlocked post-acquisition and continued R&D innovations driving efficiencies in the manufacturing process. Given two recent acquisitions, we believe management has proven their ability to successfully integrate and bring down aggregate costs, which gives us confidence in the firm’s ability to maintain operating expenses and continue to get incremental margin expansion moving forward.

Balance Sheet

MKS has a strong balance sheet with plenty of cash for any upcoming acquisitions, debt payments, and other investments. Since the acquisition of Newport in 2016, the firm has maintained a strong liquidity position, with a ~4x current ratio, ~3.5x quick ratio and ~2x cash ratio. The firm has ~$816.8M in long-term debt outstanding, the majority of which was to fund the purchase of ESI in 2019. The company regularly repays obligations early and sports a manageable cost of debt ~3.4%. Given the firms strong capital structure, with ~40% debt to assets and 70% debt to equity, we are confident in the company’s ability to service debt obligations over the medium term.

In 2019, the combination of the ESI acquisition and a challenging WFE spending backdrop led to a challenging environment in which the company saw meaningful declines in operating metrics (ROA, ROE, ROIC) down from trend (~15-20%) to ~5%. The company has seen a better WFE spending environment in 2020 (working through meaningful supply chain headwinds from COVID-19 and ongoing US/China trade tensions). Based on the first three quarters of the year and our fourth quarter estimates, we assume MKS can get back to near 2018 levels in 2020 and will continue to grow over the next coming years. Given management success with previous acquisitions and a less semiconductor dependent MKS, we are confident in management’s ability to get back to returns in excess of cost of capital (15-20%) over the next two years.

Model Assumptions and Valuation

Revenue Model

We model MKS revenue by segment using growth rates applied to semiconductor and advanced end markets. Management has guided to a long term (2020-2025) model growing at WFE + 200bps for the semiconductor markets revenue CAGR and advanced markets revenue CAGR of GDP + 300bps. Given the low visibility of semiconductor demand, we only forecast three years out and assume a semiconductor revenue CAGR (2021E-2023E) of ~7.9% (+~300bps over the long-term CAGR of WFE spend from 2004-2020 (~4.5%) and advanced market revenue CAGR of 12.7% (off depressed 2020 numbers; ~900bps over global GDP assuming ~3-4% growth). This gives us a modeled revenue CAGR at the company level of ~10% over the three years. As we mentioned above, management (and we) do not expect the composition of revenue to change meaningfully from the ~60% semi/40% advanced markets revenue profile over the life of the model.

Costs & Margins

MKS follows a pretty sticky operating profile with reasonably predictable operating expenses. We model MKS expenses and margins using expenses as a percent of revenue which are largely unchanged and in-line with historical proportions and gross margins by assuming moderate margin expansion by business unit. We believe this is in-line with management’s long-term model guidance. We would also note that MKS has historically been conservative with their guidance and have exceeded expectations regularly in the past.

On the gross margin side, we assume near-trend gross margins for the legacy MKS business (V&A) with the margin expansion coming from the successful integration of Newport and ongoing integration of ESI. By 2023, we assume gross margins of ~45-46% for V&A, ~49-50% for Newport (L&M) and ~50-51% for ESI (E&S). This gets us an MKS consolidated gross margin of ~47.5% by year-end 2023, which is on the way to long-term gross margin targets of ~50% by 2025.

Other Operating Considerations

This section will be brief and touch on other operating costs and financings detailed in the model. As we have discussed, the company has ~$816M in long-term debt outstanding. We believe that the balance sheet is more than durable enough to service outstanding obligations and leave plenty of flexibility for asset purchases or M&A. As we mentioned, the company has a manageable cost of debt ~3.4% and plenty of liquidity on the balance sheet to service that cost. Over the life of the model, we have interest expense decreasing from ~$29M in 2020 to 2023E interest expense of ~$24.5M, in-line with management estimates.

The company also pays a dividend of ~$0.20 per share. While the company has grown the dividend in past years, the dividend has been unchanged since 1Q18 and we assume no dividend growth in the model. The company’s payout ratio currently stands ~12.7% and we expect sub-20% payout ratios moving forward throughout the model with 2023E payout ratio of ~7%.

Model Summary

The below table summarizes our model’s assumptions and end products at a high level:

Valuation

We value MKSI using a sum of the parts methodology, applying a multiple on the semiconductor and advanced market components of earnings per share (EPS). We used an 18x multiple on semiconductor markets earnings and a 20x multiple on that of advanced markets. Our model suggests an intrinsic value of ~$205 and implies an EV/2023E Revenue of ~3.8x and aggregate P/E of ~18.8x 2023E EPS. The intrinsic value estimate suggests ~38.6% upside from spot prices.

Risks to the estimate include:

COVID-19 remains a key risk to the thesis. MKSI has seen supply chain disruptions in 2020 which have weighed on top-line growth. We are optimistic that a health care solution will help mitigate this risk over 2021.

Operational execution – MKSI growth going forward will be driven by operational execution in penetrating new advanced end markets, navigating cyclicality in the semiconductor industry and successful M&A campaigns fueling external growth. In the case MKS cannot do this, we will need to re-underwrite the thesis.

Ongoing US/China trade tensions – the US/China trade war has posed disruptions to MKSI’s supply chain but has caused minimal hiccups to date. With new additions to the US blacklist and ongoing bipartisan rhetoric in the US political scene against China, we will be monitoring the situation closely. Any material deviation in US/China trade tensions may lead to a re-underwriting of the thesis.

Cyclicality – the business is still largely driven by semiconductor end markets. These industries have had high cyclicality historically and this may continue to be the case in the future. While the business has worked to lessen their dependence on semiconductors, large swings in WFE spending may lead to significant declines in revenue, margins and free cash flow.

Analyst Coverage History

Note we have covered MKSI since early 2020. The below graphic illustrates our coverage history on the company.

Disclaimer & Disclosure: We do own a long position in MKSI. This information is for research purposes only and is not investment advice. Please do your own research prior to any investment decision. Past performance is not indicative of future results.

If you enjoyed this post, please share & subscribe for more updates.